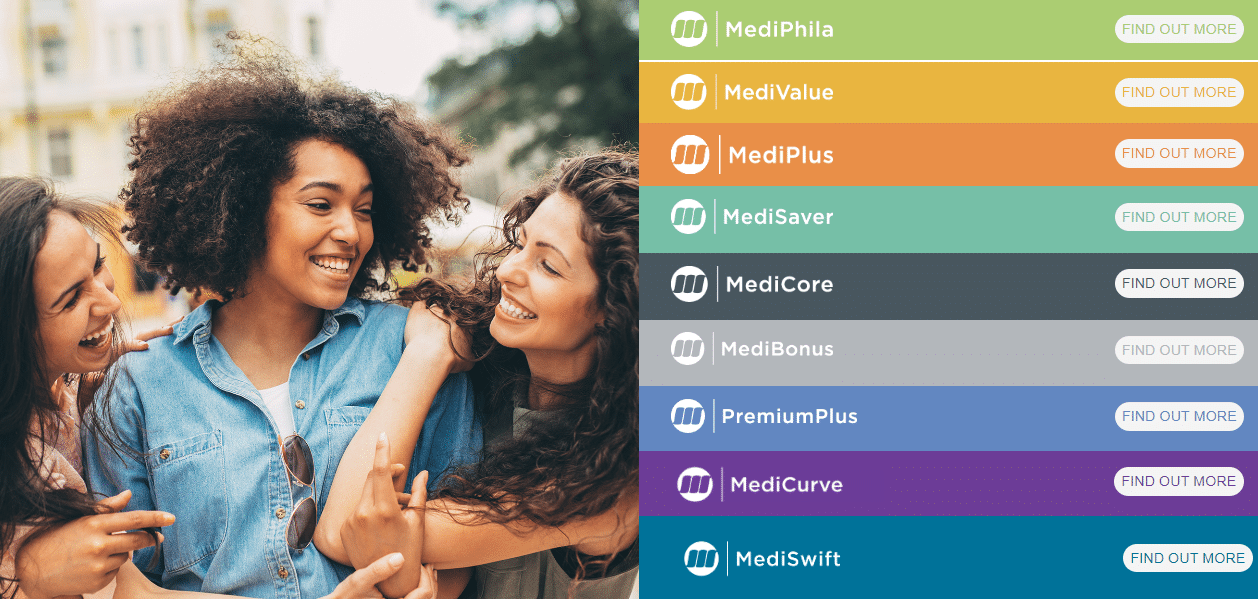

Overall, Medshield offers 11 medical aid plans (PemiumPlus, MediBonus, MediSaver, MediPlus Prime, and others) starting from R1,584 per month. Additionally, Medshield offers 24/7 emergency support but does not offer native comprehensive gap cover any policy.

| 🔎 Medical Aid | 🥇 Medshield |

| 📌 Registration Number | FSP 51381 |

| 👥 The average number of members | 250,000+ |

| 📈 Number of Markets | South Africa |

| 📉 Number of Employees | 500 – 1,000 |

| 📊 GCR Rating | AA- |

| ✔️ Listed on the JSE | No |

| 🔍 JSE Stock Symbol | None |

| 📍 The most recent Market Cap reported | None |

| 💙 Average Customer Rating | 3.5/5 |

| 🔎 Medical Aid | 🥇 Medshield |

| 📌 Date Established | 1968 |

| 📍 Headquartered | Gauteng, South Africa |

| 🚩 Registration Number | FSP 51381 |

| 👥 The average number of members | 250,000+ |

| 📎 Number of Markets | South Africa |

| 👤 Number of Employees | 500 – 1,000 |

| 📈 GCR Rating | AA- |

| 📉 Listed on the JSE | No |

| 📊 JSE Stock Symbol | None |

| ⚠️ The most recent Market Cap reported | None |

| 💙 Average Customer Rating | 3.5/5 |

| ☑️ Average Number of Reviews | 900+ |

| ✅ Market Share | |

| 🔟 Number of plans | 11 |

| 🚑 Number of Hospitals in Network | 200+ |

| 🏠 Home care | ✅ Yes |

| 🔎 Sponsorships | None |

| 📱 Mobile App | ✅ Yes |

| 📖 Medshield Magazine for clients | No |

| 💻 Medical Claims Portal | ✅ Yes |

| 😷 Information Hub for COVID-19 | ✅ Yes |

| ⚕️ Chronic Illness Benefits | ✅ Yes |

| 📌 Number of PMB Diagnoses | 26 |

| 📍 Number of PMB Chronic Conditions | 54 |

| 💻 Screening and Prevention offered | ✅ Yes |

| 👶 Maternity Benefit | ✅ Yes |

| 💵 Medical Aid Contribution Range (ZAR) | 1,584 – 7,842 ZAR |

| ⛔ Average Waiting Period | Up to 12 months |

| 💷 Late-joiner penalties charged | ✅ Yes |

The Council for Medical Schemes regulates Medshield Medical Scheme. The Council governs South Africa’s medical plan business for Medical Schemes (CMS), a regulating body set up under the Medical Schemes Act, No. 131 of 1998 (the Act). The CMS is responsible for a range of tasks related to the oversight of medical insurance plans, such as:

Furthermore, if a medical scheme is found to violate the law, the CMS has the authority to issue administrative fines and penalties.

| 🔎 Plan | 💴 Contributions Range | 💵 Contributions (+ Adult) | 💶 Contributions (+ Child) | 💷 Medical Savings (Up to) | 📌 Overall Annual Limit | 📍 CDL Conditions | 🚩 DTP Diagnoses |

| 1️⃣ MediCurve | 1,584 ZAR | 1,584 ZAR | 1,584 ZAR | None | Unlimited | 26 | 271 |

| 2️⃣ MediPhila | 1,851 ZAR | 1,851 ZAR | 477 ZAR | None | Unlimited | 26 | 271 |

| 3️⃣ MediSwift | 2,037 ZAR | 1,986 ZAR | 522 ZAR | None | Unlimited | 26 | 271 |

| 4️⃣ MediValue | 2,736 ZAR | 2,388 ZAR | 711 ZAR | None | Unlimited | 26 | 271 |

| 5️⃣ MediValue Compact | 2,478 ZAR | 2,166 ZAR | 696 ZAR | None | Unlimited | 26 | 271 |

| 6️⃣ MediCore | 3,474 ZAR | 2,940 ZAR | 801 ZAR | None | Unlimited | 26 | 271 |

| 7️⃣ MediPlus Prime | 4,539 ZAR | 3,240 ZAR | 1,017 ZAR | None | Unlimited | 26 | 271 |

| 8️⃣ MediPlus Compact | 4,125 ZAR | 2,943 ZAR | 927 ZAR | None | Unlimited | 26 | 271 |

| 9️⃣ MediSaver | 4,524 ZAR | 3,747 ZAR | 1,101 ZAR | · 679 ZAR (Main) |

· 562 ZAR (+1 Adult)

· 1,437 ZAR (+1 Adult)

It is impossible to predict when you will require medical care or treatment and, more critically, whether you will have sufficient cash to afford the charges. MediCurve provides first-time medical coverage that matches the lifestyle of the young and healthy. Members can expect the following from this plan:

There is no way of knowing when you or a family member will require expensive medical care. As a member of MediPhila, you can enjoy limitless hospital coverage for PMB-eligible diseases and generous limits for In-Hospital treatments not covered by PMB. In addition, the Out-of-Hospital benefit limit for certain services covers your fundamental everyday healthcare requirements. Furthermore, the following are features of the MediPhila plan:

MediSwift is an unlimited hospital plan that covers in-hospital costs associated with major medical emergencies. MediSwift provides unlimited In-Hospital coverage via the Compact Hospital Network, with In-Hospital procedures reimbursed at the Medshield Tariff (100%) and an added physiotherapy & biokinetics benefit for amateur athletes. MediSwift provides no Day-to-Day coverage as a hospital plan, leaving healthy, active persons to manage their own everyday healthcare.

MediValue is the optimal alternative for persons requiring comprehensive coverage for hospital operations and emergencies and partial coverage for daily healthcare. MediValue also provides unrestricted In-Hospital services via the applicable Hospital Network and limited Out-of-Hospital coverage for basic healthcare needs. Medshield has divided the MediValue option into two sub-categories, MediValue Prime and MediValue Compact, to provide more options. All benefits offered and displayed are identical for all categories. However, MediValue Compact requires networks, care coordination, the nomination of a Family Practitioner, and the Family Practitioner-to-Specialist referral process.

In a catastrophic medical emergency, everyone should have unlimited in-hospital coverage. Through the Medshield Hospital Network, MediCore provides unlimited In-Hospital coverage, with specific In-Hospital operations reimbursed at a higher rate (Medshield Private Tariff 200%) than the Medshield Tariff (100%). Furthermore, this plan has no Day-to-Day benefits. Therefore, it is suitable for persons in good health who can manage their own daily medical expenses.

MediPlus is the solution for middle- to upper-income earners who require hospitalization and outpatient coverage. Members receive unlimited In-Hospital coverage through the applicable Hospital Network, and the daily Out-of-Hospital coverage includes the following benefits:

Medshield has divided the MediPlus option into two subcategories, MediPlus Prime and MediPlus Compact, to provide more options. All benefits offered and represented are identical for both categories. However, MediPlus Compact requires networks, care coordination, the nomination of a Family Practitioner, and the Family Practitioner-to-Specialist referral process.

MediSaver is ideal for those who wish to take charge of their healthcare costs and plan to start their own family. Members of MediSaver have access to unrestricted in-hospital care through the Compact Hospital Network. In addition, members are responsible for their out-of-hospital expenses through a Health Savings Account.

MediBonus allows families and individuals to manage their daily healthcare costs with a Day-to-Day Limit and unlimited In-Hospital insurance for certain In-Hospital treatments charged at a Medshield Private Tariff of 200%. MediBonus is a trustworthy medical aid option for a family.

Unlimited In-Hospital Coverage with Selected In-Hospital Procedures Paid at a Medshield Private Tariff of 200% and the Freedom to Manage Everyday Healthcare Expenses with a Personal Savings Account are just two benefits PremiumPlus offers to families and professionals.

Medshield offers two plans that have Medical Savings Accounts, namely:

The members’ day-to-day benefits on this plan consist of a Personal Savings Account. Furthermore, they are allocated six months in advance for Out-of-Hospital services.

| 🔎 Member | 💵 Medical Savings Account |

| 👤 Main Member | 623 ZAR |

| 👥 Adult Dependent | 516 ZAR |

| 👶 Child Dependent | 152 ZAR |

Comprises a Personal Savings Account for Out-of-Hospital services, a Self-payment Gap Cover, and an Above Threshold Benefit for certain benefits.

| 🔎 Member | 💵 Medical Savings Account |

| 👤 Main Member | 1440 ZAR |

| 👥 Adult Dependent | 1319 ZAR |

| 👶 Child Dependent | 275 ZAR |

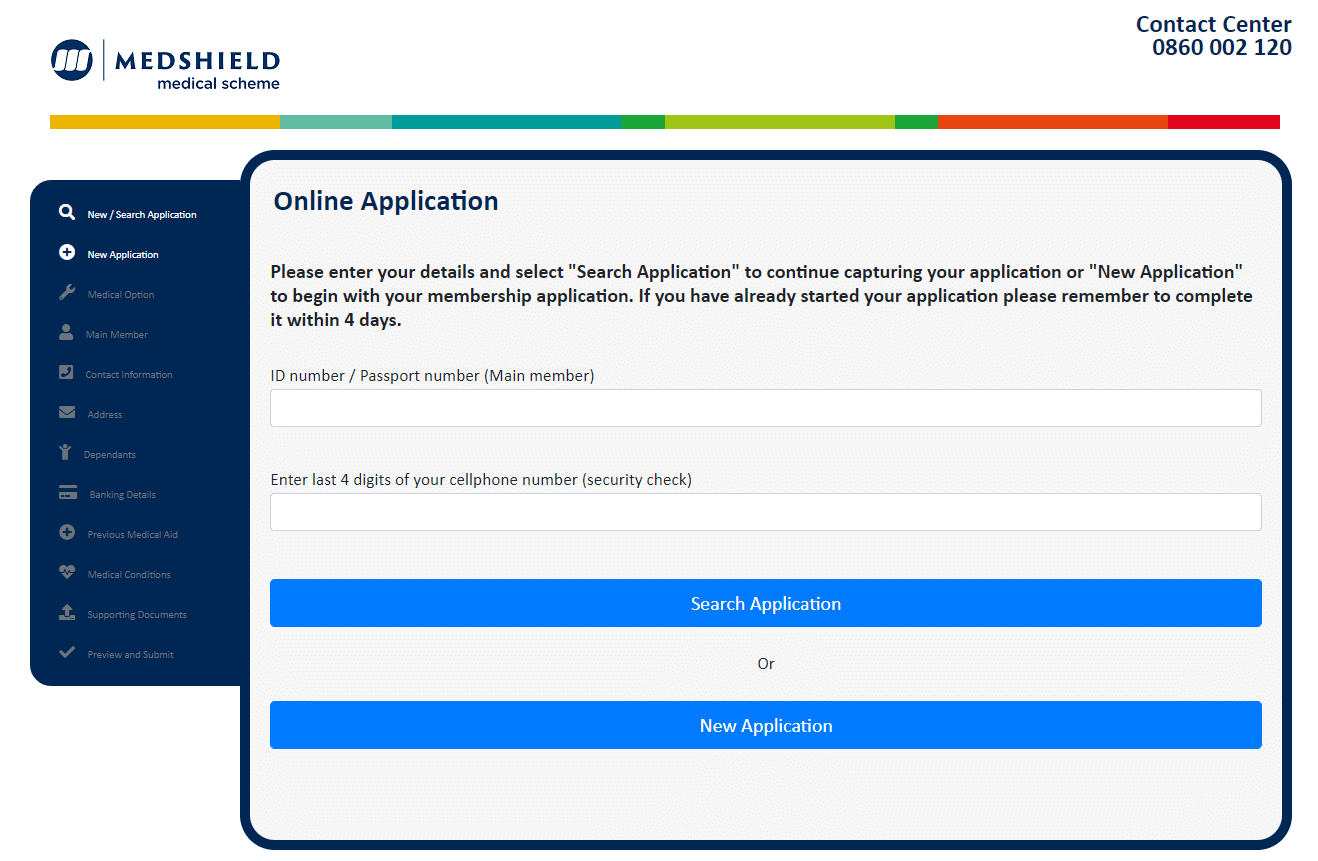

To apply for Medical Aid through Medshield, you must:

Get a Medshield Medical Aid quote from our Dedicated Medical Aid Specialists Broker

To submit a claim to Medshield, members can scan and email their claim. Alternatively, members can post their claim to Medshield or drop it off at a Medshield branch. Before submitting a claim, members must ensure that they provide the following information:

Compliments and Complaints can be directed to Medshield via the following:

All complaints will be managed according to the escalated complaints system to guarantee a fair and timely resolution.

To switch from your present medical aid to Medshield Medical Aid, you must notify your current medical aid of canceling coverage. After advising your current medical plan of your desire to quit coverage, you can apply to Medshield Medical Aid via their website or by completing the application procedures over the phone.

You can contact Medshield customer support by calling their customer service number, which can be found on their website, or by searching for it online. Additionally, you may also be able to contact them through email or by filling out a contact form on their website.

| 🔎 Medical Aid | 🥇 Medshield | 🥈 Sizwe Hosmed Medical Aid Scheme | 🥉 Platinum Health |

| 📌 Years in Operation | 55 Years | 35 Years | 22 Years |

| 👥 Average # Members | 250,000+ | 172,000+ | |

| 📈 GCR Rating | AA- | A+ | A+ |

| 👤 Number of Employees | 500 – 1,000 | 500 – 1,000 | 100+ |

| 📉 Market Share | |||

| 📊 Market Coverage | South Africa | South Africa | South Africa |

| 💙 Customer Rating | 3.5 | – | 3/5 |

| ➡️ Number of reviews | 900+ | 3,000+ | |

| 📱 Mobile App | Yes | Yes | No |

| 💶 Contribution Range (ZAR) | 1,584 – 7,842 ZAR | ZAR | ZAR |

| 🌎 International Travel Benefit (ZAR) | – | 100% of the Scheme Rate | – |

| ✔️ Market Capitalization | – | – | – |

You might also like Medshield comparisons with other medical aid schemes:

Satisfied Member.

I am writing to express my deepest appreciation for the excellent service provided by Medshield. I am extremely satisfied with the company. I am particularly grateful for their presence and support when my child was ill. Additionally, I would like to commend the prompt response of the company. Finally, I request the Marketing team to contact me, as I would like to submit a positive review of Medshield personally. – Norma Todd

Great Support.

I emailed the credit department requesting a confirmation letter for my SARS submission at 10 pm one night. I was pleased to receive the requested letter first thing in the morning, indicating a prompt and efficient response. I must commend the department for its exceptional service. – David Potts

Best in The Industry.

Medshield medical scheme is by far the best in the industry. Very professional client service, affordable premiums and I must say, after juggling different schemes in financial services for more than 12 years, I can honestly say I’ve found the best! – Daisy Petty

3 Star Rating" width="278" height="65" />

3 Star Rating" width="278" height="65" />

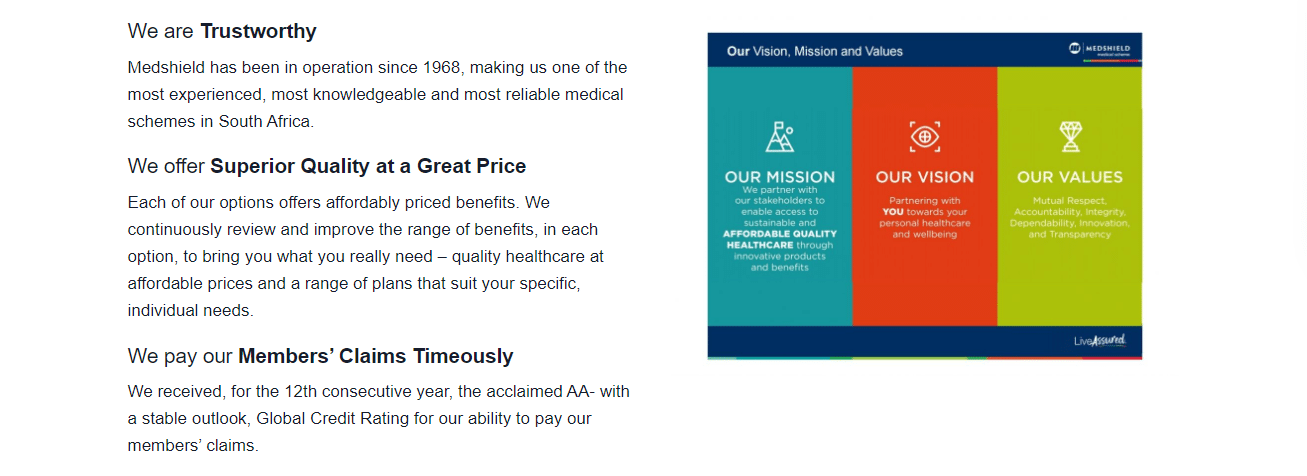

Medshield prides itself on being transparent regarding its plans. Furthermore, Medshield plans are affordable, easily accessible, and easy to understand. Medshield offers plans for every type of budget in South Africa, and the scheme is reputable in the industry. Medshield has an AA- GCR rating and a proven payment record. In addition, Medshield offers a range of benefits across all plans and provides dedicated customer support across communication channels.

Read more in-depth the following plans MedShield has to offer:

| ✅ Pros | ❎ Cons |

| Medshield offers a diverse range of plans | Medshield does not have a gap cover |

| 24/7 emergency support is available | The savings offered are much lower than that offered by competitors |

Medshield is a well-established medical insurance company founded in 1968 and, following its merger with Oxygen, now covers over 250 000 lives.

Typically, there is a waiting period for pre-existing conditions. This is to prevent new members from abusing medical insurance for a short period to finance pricey procedures and then canceling their membership shortly after that.

MediValue starts from 2,478 ZAR on the Compact option.

You can log into the client portal on Medshield and find your tax certificate on your portfolio. In addition, Medshield will email your tax certificate yearly.

You can compare Medshield’s options on the official website.

Changes to options must be requested by no later than the 31st of December to take effect on the 1st of the following fiscal year, as per the Scheme’s rules. In addition, members can downgrade their plan with Medshield by downloading and printing the “Option Change Request” form.

If you want to add a child or adult dependent, you can log into your Medshield profile and print the “Member Record Amendment/Dependent Registration” form.

Adriaan holds an MBA and specializes in medical aid research. With his commitment to perfection, he ensures the accuracy of all data presented on medicalaid.com every three months. When he is not conducting research, Adriaan can be found indulging in his passion for trout fishing amidst nature.