Commonly Used Invoice Terms and Conditions with Examples!

As a business owner or freelancer, sending invoices is a regular task, but ensuring prompt payments can be a challenge. That’s where having clear invoice terms and conditions is important. Think of invoice terms and conditions as the ground rules for your invoicing process. They outline the expectations and agreements for your financial transactions with clients. Whether you’re experienced in business or just starting out, understanding these terms is important for managing your finances effectively. In this blog post, we’ll discuss why invoice terms and conditions are important and what they typically cover. We’ll also provide some invoice terms and conditions to get you started. Whether you’re working independently or managing a small team, getting your invoicing process right begins with straightforward and transparent terms and conditions. Let’s get started.

Table of Contents:

- What are Invoice Terms and Conditions?

- Why are Invoice Terms and Conditions important?

- Common Invoice Terms and Conditions

- How CheckYa Can Help

- Conclusion

What are Invoice Terms and Conditions?

Invoice terms and conditions refer to the guidelines outlined on an invoice that specify the terms of payment and other relevant conditions related to a transaction between a service provider and a client. These terms and conditions typically cover various aspects of the billing process, including payment deadlines, accepted forms of payment, late fees, discounts, and dispute resolution procedures.

Why are Invoice Terms and Conditions important?

Here’s why having clear invoice terms and conditions is important for your business:

1. Ensuring Timely Payments

One of the primary benefits of having clear invoice terms and conditions is ensuring timely payments from your clients. By clearly stating the payment due date, late fees, and any penalties for overdue payments, you set clear expectations for when you expect to be paid. This clarity helps to minimize misunderstandings and excuses for late payments, ultimately improving your cash flow and financial stability. Furthermore, including incentives for early payment, such as discounts or bonuses, can encourage clients to settle their invoices promptly, further reducing the risk of payment delays. Ultimately, having clear payment terms can help you maintain a steady income stream and avoid the frustrations and financial strain associated with late payments.

2. Establishing Clear Expectations

Clear invoice terms and conditions also play a crucial role in establishing clear expectations between you and your clients. By outlining the scope of your services, payment terms, and any additional fees or charges upfront, you mitigate the risk of disputes or misunderstandings down the line.

When both parties understand their rights and obligations regarding payment, deliverables, and dispute resolution, it fosters trust and transparency in your business relationships. Clients know exactly what to expect in terms of payment deadlines, payment methods, and any potential consequences for non-compliance, leading to smoother interactions and fewer disagreements.

3. Protecting Your Business Interests

Perhaps most importantly, clear invoice terms and conditions help to protect your business interests. By including provisions related to late fees, interest charges, and dispute resolution processes, you establish mechanisms to address non-payment or payment disputes effectively. In the event of a payment dispute or non-payment, having clearly defined terms and conditions provides you with a legal basis to pursue overdue payments through formal channels, such as collection agencies or small claims court. This can help you recover outstanding debts and minimize the financial impact of unpaid invoices on your business.

Common Invoice Terms and Conditions:

1. Payment Terms

- Net-X Days: This term indicates that payment is due within a certain number of days after the invoice date. For example, “Net-30” means payment is due within 30 days of the invoice date.

- MFI (Month Following Invoice): Payment is due in the month following the invoice date. For example, if an invoice is issued in January, payment is due by the end of February.

- PIA (Payment in Advance): Payment is required before the goods or services are provided. This is also known as prepayment.

- CIA (Cash in Advance): Similar to PIA, CIA requires payment before goods or services are delivered, but typically implies immediate payment upon ordering.

- Upfront: Payment is required upfront before any work or services are provided.

- COD (Cash on Delivery): Payment is made at the time of delivery of goods or completion of services.

- EOM (End of Month): Payment is due at the end of the current month.

- Upon Receipt: Payment is due immediately upon receipt of the invoice.

- CWO (Cash with Order): Payment is required when placing the order, before goods are shipped or services are provided.

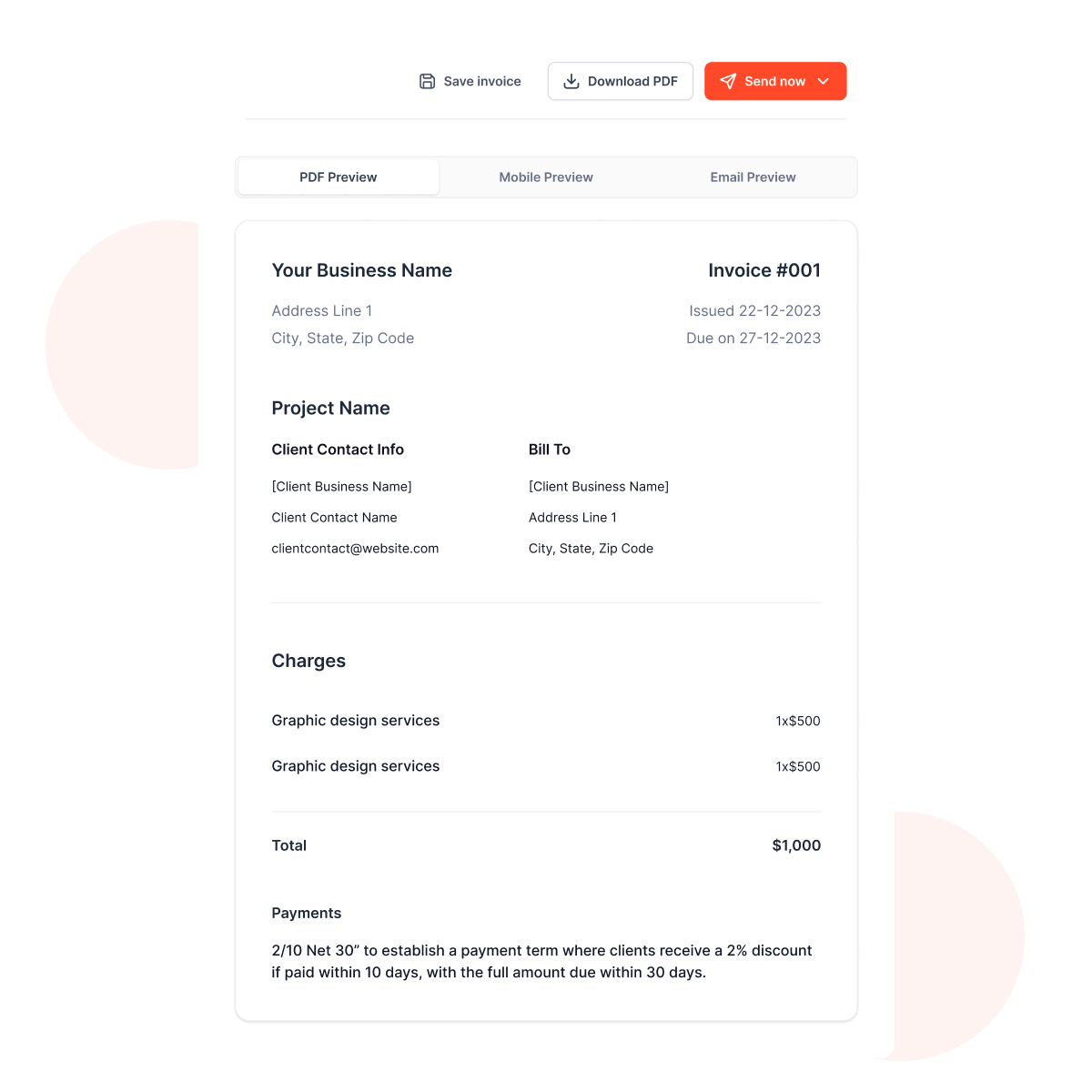

- N/N Net-X Days: This term refers to a discount offered for early payment. For example, “2/10 Net-30” means a 2% discount is offered if payment is made within 10 days, otherwise, the full amount is due within 30 days.

- CND (Cash Next Delivery): Payment is made at the time of the next delivery of goods or completion of services.

Following are some of the Examples of Payment terms and conditions that you can copy/paste to your invoice:

Invoice Terms and Conditions Example:

- Net-X Days: Payment is due within 30 days of the invoice date (Net-30).

- MFI (Month Following Invoice): Payment is due by the end of the month following the invoice date.

- PIA (Payment in Advance): Payment is required before the services are rendered.

- CIA (Cash in Advance): Immediate payment is required upon ordering.

- Upfront: Payment must be made upfront before any work begins.

- COD (Cash on Delivery): Payment is made at the time of delivery.

- EOM (End of Month): Payment is due by the end of the current month.

- Upon Receipt: Payment is due immediately upon receipt of the invoice.

- CWO (Cash with Order): Payment is required when placing the order.

- N/N Net-X Days: A 2% discount is offered for payments made within 10 days, otherwise, full payment is due within 30 days (2/10 Net-30).

- CND (Cash Next Delivery): Payment is made at the time of the next delivery or completion of services.

2. Payment Methods

- Accepted Forms of Payment: This section outlines the methods of payment that the seller or service provider accepts, such as credit cards, bank transfers, checks, or electronic payment platforms like PayPal or Stripe.

- Online Payment Options: Some businesses offer online payment options to make it more convenient for clients to settle their invoices. This may include links to payment portals or instructions for making payments online.

- “We accept payments via credit card, bank transfer, or PayPal.”

- “You can conveniently pay your invoice online through our secure payment portal.”

3. Discounts and Incentives

- Early Payment Discounts: Early payment discounts are incentives offered to encourage clients to settle their invoices before the due date. These discounts are typically expressed as a percentage of the total invoice amount.

- Volume Discounts: Volume discounts are discounts offered for large or bulk orders. These discounts incentivize clients to place larger orders or make recurring purchases.

- “Take a 5% discount if payment is received within 10 days of the invoice date.”

- “Receive a 10% discount on orders over $1000.”

4. Late Payment Consequences

- Late Fees: Late fees are charges imposed on overdue invoices to incentivize prompt payment. These fees are typically calculated as a percentage of the outstanding balance or a flat fee.

- Interest Charges: Interest charges may be applied to overdue invoices to compensate for the cost of delayed payment. The interest rate is usually stated as an annual percentage rate (APR).

- “A late fee of $25 will be charged for invoices not paid within 15 days of the due date.

- “An annual interest rate of 12% will be applied to overdue invoices.”

5. Dispute Resolution Process

- Procedures for Addressing Payment Disputes: This outlines the steps to follow in the event of a payment dispute, including how to notify the other party, provide evidence, and attempt to resolve the issue amicably.

- Escalation Process if Disputes Cannot Be Resolved: If a payment dispute cannot be resolved informally, this section details the escalation process, such as mediation, arbitration, or legal action.

Example: “If a payment dispute cannot be resolved through negotiation, both parties agree to enter into mediation before pursuing legal action.”

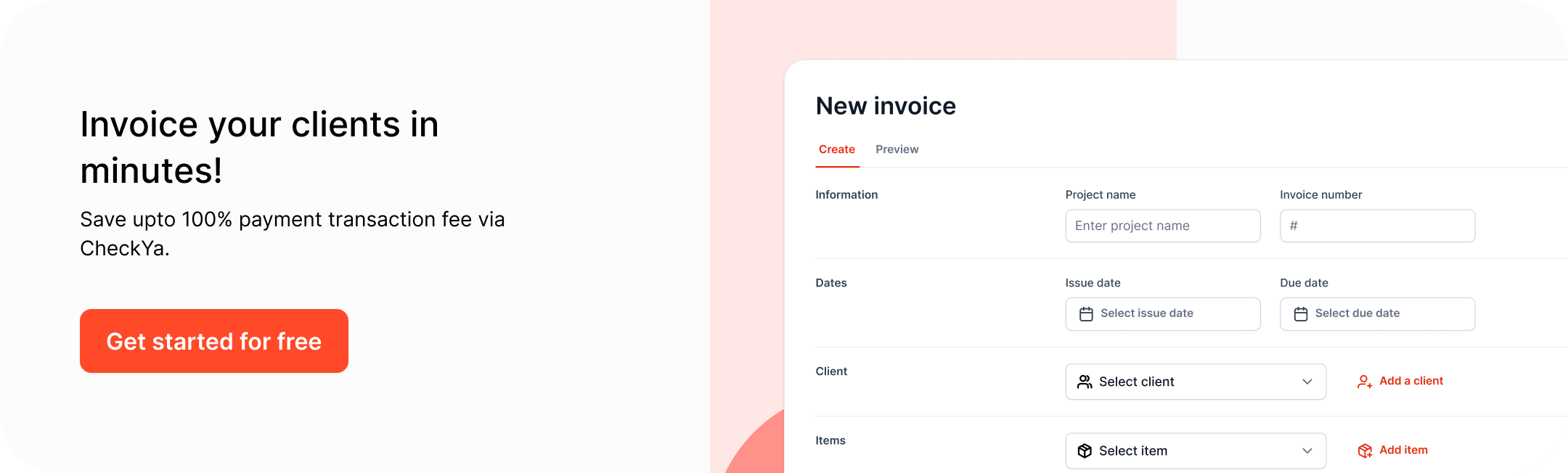

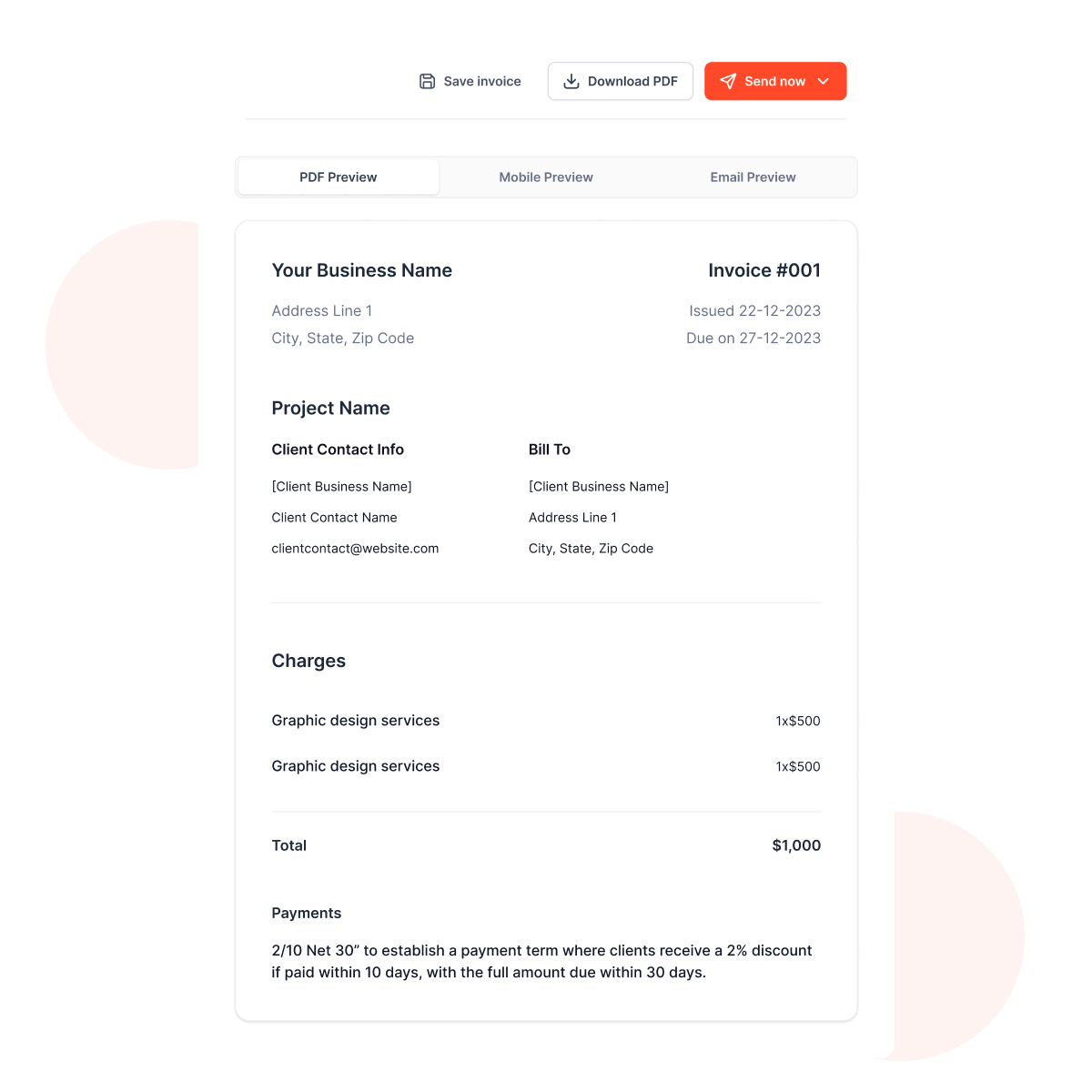

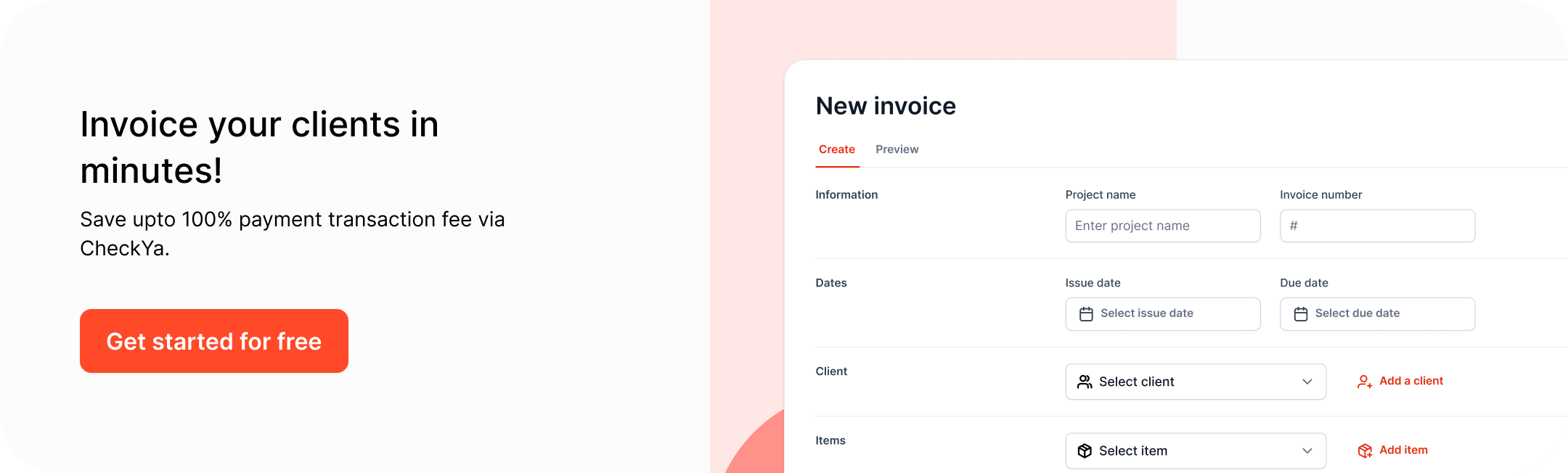

How CheckYa Can Help?

Creating invoices and ensuring they contain the right payment terms is importantl for getting paid promptly. However, many small businesses and freelancers often find themselves short on time to create these formal documents, especially if they lack a dedicated accounts department.

But what if there was a solution that could streamline the invoicing process, boost productivity, and provide valuable insights into your finances? That’s where CheckYa comes in.

CheckYa offers a comprehensive invoicing solution that helps you save time, increase productivity, and stay on top of your invoicing needs.

Here’s how CheckYa can benefit you:

- Automated Reminders: With CheckYa, you can set up automated reminders to be sent to clients upon overdue payments, helping you avoid late fees and ensuring timely payments.

- Invoice Status: Keep track of all your invoices in one convenient dashboard. CheckYa allows you to monitor paid, unpaid, and overdue invoices at a glance, giving you valuable insights into your financial status.

- Multiple Payment Options: CheckYa offers flexibility in payment methods, allowing you to accept payments from a variety of sources including Google Pay, Apple Pay, credit cards, debit cards, ACH, and PayPal. This versatility makes it easier for your clients to settle their invoices promptly.

- Payment Processing Fee Splitting: By using CheckYa, you can split payment processing fees with your clients, potentially saving 50-100% of your payment processing costs. This feature helps you maximize your revenue while offering convenience to your clients.

Why Consider CheckYa Invoices?

- Save Time: Spend less time creating invoices and chasing payments, and more time focusing on growing your business.

- Improve Cash Flow: Get paid faster with automated reminders and multiple payment options, improving your cash flow and financial stability.

- Increase Productivity: Streamline your invoicing process and boost productivity with CheckYa’s user-friendly platform.

- Gain Insights: Track your invoice payments and gain valuable insights into your financial performance with CheckYa’s intuitive dashboard.

Ready to streamline your invoicing process and get paid faster? Try CheckYa invoices today for free and experience the difference it can make to your business.

Conclusion:

In conclusion, now that you’ve the understanding of invoice terms and conditions, use the examples provided when sending out your next invoice to ensure prompt payment. Incorporate clear terms like due dates and late fees to set expectations with your clients. Additionally, consider tools like CheckYa to streamline your invoicing process, saving time and improving efficiency. With all the above practices in place, you can get paid promptly and achieve financial success in your business.